canadian tax strategies for high income earners

High income family members with surplus funds. Although these specifications are in general good fits for average tax rates their estimates.

Using the administrative tax return database we document the Canadian income and tax statistics in 2000 and in 2016 and compare them with those of the US.

. However prior to the 2018 federal budget high earning individuals enjoyed two. Income splitting can also apply to pension income. The use of these strategies will vary based on personal.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. They might soon have to pay their fair share of income taxes. Similar to income splitting this strategy may lower the overall tax obligation for a family and may be suitable for higher income families with liquid assets.

That said high-income earners have been put on notice. That means that if you earn more than 170050 in gross income as a single earner and 340100 if you are married and filing jointly you are a high-income earner. A non-exhaustive list of tax minimization strategies to consider with your.

RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. Your RRSP limit for the current year 2018 is shown on your 2017 Notice of Assessment. Here are a couple of tax planning strategies that will be highly effective for you.

The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly. Taking advantage of all of your allowable tax deductions and credits. Also we estimate parametric tax specifications used in applied macroeconomic and public finance studies.

Briefly it involves a higher income family member loaning a lower income member funds at the government prescribed rate of interest. However prior to the 2018 federal budget high earning individuals enjoyed two effective strategies to reduce their overall tax burden income splitting and reinvesting undistributed earnings from an active business into a private corporation. A major risk to taxpayers and investors is slow growth in Canada which.

To reduce the impact of tax on passive income from investments couples can spread the wealth around using a loan whereby a. Make a loan to your spouse. High income earners have a very solid option with RRSPs in reducing taxes.

RRSP withdrawals are taxed at your marginal tax rate. Withdrawals get hit with a withholding tax that is paid upon withdrawal. Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent.

Back on Tuesday 28th Finance Minister Bill Morneau proposed to close three loopholes that let high-income earners pay lower corporate tax rates. While the money you contribute to your TFSA will be post-tax income any interest dividends or capital gains earned in it are tax-free for life and you wont have to pay taxes on the withdrawals. Tax Planning Strategies For High-Income Canadians March 8 2019 When personal income exceeds 200000 in Canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence.

Of 50 or higher when your income exceeds 200000. This is one of the most popular tax deferral strategies for high-income earners because of higher limits that can be invested. As such it is crucial to check with your qualified tax advisor.

Tax saving strategies for high income earners canadaHere are 50 tax strategies that can be employed to reduce taxes for high income earners. For two unskilled workers this would half the cost of car ownership to about 18 of lifetime earnings Opel Corsa provided the overall distance driven does not increase. You make contributions with after-tax dollars but the money can grow tax-free and withdrawals up to the amount of premiums paid are not taxed.

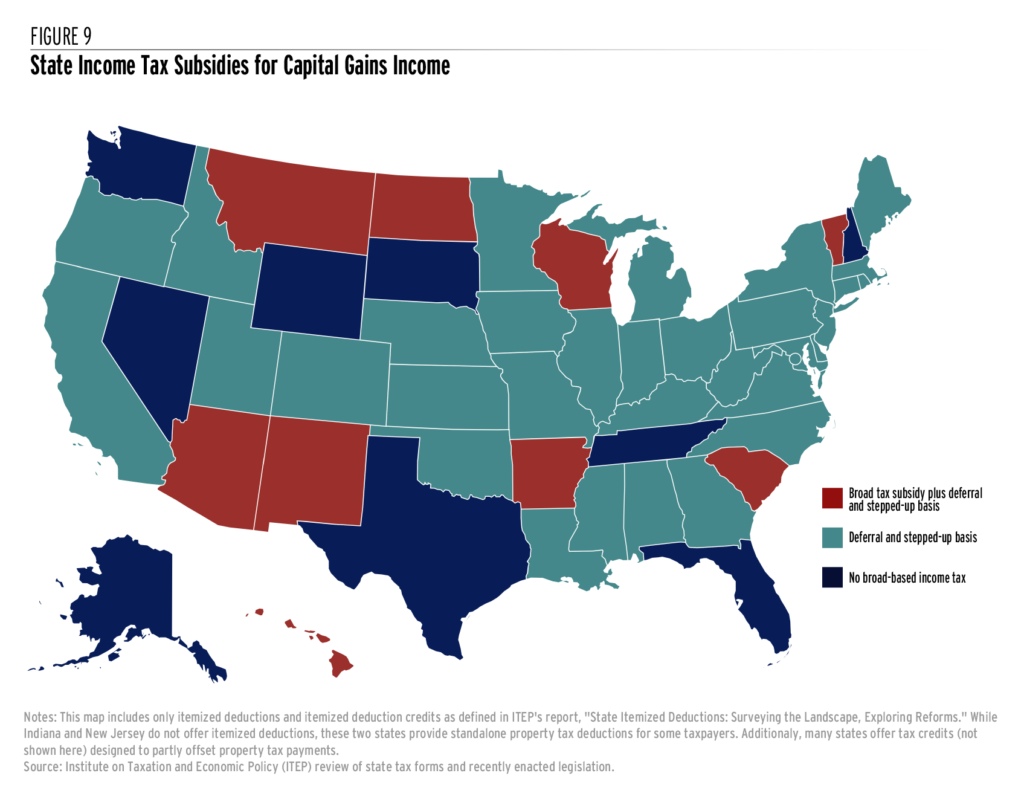

RRSP limit for the year. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million. The SECURE Act which became law at the end of 2019 includes several provisions that apply to.

Capital Gains Deduction Loophole Restrictions that have now been nixed regarding capital gains deductions would have targeted the money earned from the sale of propertyshares over and above a purchase. RRSP contributions are tax deductible and any income and gains earned inside a RRSP are not taxable. 50 Best Ways to Reduce Taxes for High Income Earners.

Otherwise attribution rules kick in and the funds will be taxed in the hands of the higher-earning spouse. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax shelter is that its less flexible. Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie.

Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner. Sheltering investment income through RRSPS is one way that the Canadian government has availed.

Pay Attention to the Medicare Surtax and Net Investment Income Tax for High Earners There are two types of Medicare tax that could be affected by your income level. Tax deductions are expenses that can be deducted from your taxable income and therefore your tax liability. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep after-tax dollars in their hands versus more of their income going to the Canada Revenue Agency.

The concept is much the same although the higher income earner can share. Chen notes that the Income Tax Act in Canada requires that the spouse receiving the funds must keep the funds in the RRSP account for three years. The benefits of the RRSPs over the TFSA arise mainly based on the tax bracket of an individual in retirement and whether it is higher or lower compared to the time of initial contribution.

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Wealthy Canadians use these accounts too though Jamie Golombek managing director of tax and estate planning at CIBC said they might use them a bit differently.

139 Best Affiliate Programs Of 2022 High Paying For Beginners

Tax Planning For High Income Canadians

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

How Do Taxes Affect Income Inequality Tax Policy Center

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How Do Taxes Affect Income Inequality Tax Policy Center

How To Reduce Taxes For High Income Earners In Canada

High Income Earners Need Specialized Advice Investment Executive

High Income Retirement How To Safely Earn 12 To 20 Income Streams On Your Savings Eifrig Jr Dr David 9780991513017 Amazon Com Books

Proposed Tax Changes For High Income Individuals Ey Us

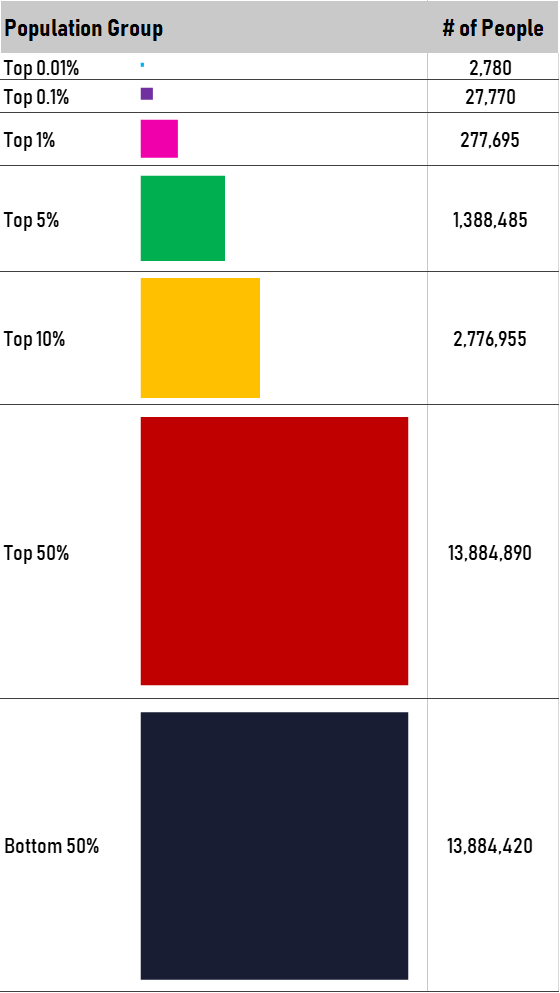

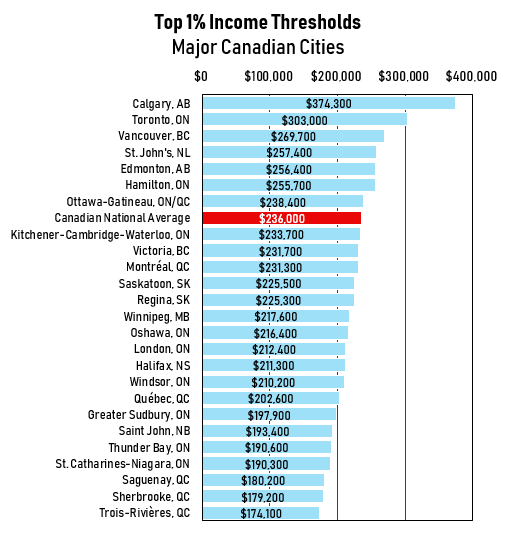

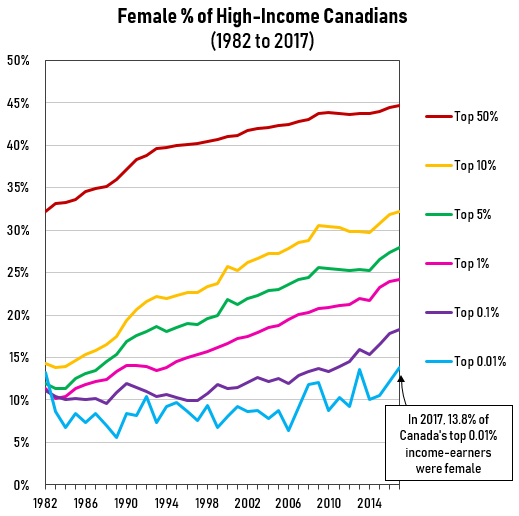

High Income Canadians Data On How Much They Earn Pay In Taxes Income Inequality And What It Means To Be A One Percenter In Different Cities Provinces Across The Country R Personalfinancecanada